This offer is for folks who are ready to sell their house and have plenty of equity or cash to pay Realtor fees. BUT… they hate the idea of paying a real estate agent a ton of money and cutting into their profits. They may also loathe the idea of having to deal with looky-loos in and out of the house, setting up time for showing, and people wasting their time from the beginning.

In this discussion, I am NOT acting as an attorney or real estate agent in these transactions. I only act as a principle… a direct buyer of your house.

Everything is done with at the closing company so rest assured, everything is legal and above board.

Here is my offer…

- I will buy your property and take over the payments on your mortgage. I will give you a second mortgage for your equity for up to 95% of the true value of the property, depending on the condition and work needed for the house.

- I will make the payments until I pay it off or sell the house.

- You will not have to do anything once you sell the property over to me… it will become my responsibility. I will maintain everything from the ground to the roof and outside as well.

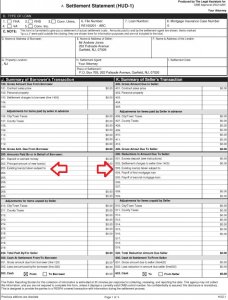

This is called, selling your house “subject to“ the existing loan. Essentially, I am buying your house for the loan amount. Although it is may seem uncommon, these transactions take place each and every day. It is both legal and ethical. It’s even listed as a line-item on HUD1 Settlement Statements.

(click image to zoom)

Click Here To Skip the Info and Sell Your House Now

A hypothetical example:

Let’s say the true market value of your house is $150,000 and the total of all liens and mortgages on the property is $90,000. We have agreed to purchase the house for $135,000.

I will take over the payments on the $90,000 mortgage and we will have the closing attorney/title company create a new junior mortgage payable from me to you of $45,000. That means I am paying you a total of $135,000 total for the property which is 90% of the real market value.

Here is how you save a ton of money…

- You will not have to pay Realtor costs (6% average).

- You will not have to pay closing costs (2% average).

- You will not have to negotiate the price (3% average).

- You will not have to pay for repairs (1% average).

- You will not have to pay carrying costs while you are waiting to sell (1% per month average).

- These costs are a total of 13%.. and this could be more depending on your or your agent’s negotiation skills

We will make payments on the underlying mortgage each and every month until we sell the house or pay off the entire loan and any profit you have from the sale. There are times where we can put a balloon on the transaction of 3-5 years.

Two Other Options

1. If you don’t want to carry your equity, one other option is for you to refinance your house and take out all your cash. Then we take over the mortgage and you are out of the deal with your cash.

2. Some folks would rather steeply discount their property rather than sell it the way I suggest above… although, personally, I don’t think it’s the best move financially – but sometimes it’s not about finances. I buy many properties for cash, but I need a discount of 30% or more below the market value before I consider it. Most people consider an offer like this an insult, so please don’t take it that way – I’m just giving you an option that many people have asked for in the past. If you’d like to sell your house fast for cash, please click here.

Here is WHY I buy properties like this and why it makes sense for you

- I can close when you are ready. This is a very simple process and takes about 15 days to close. If you need to wait, that’s not problem either, just let us know when you want to close and we’ll be there at that time.

- After we sign the simple paperwork at the title company/attorney to purchase your house, you don’t have to do anything. I handle everything and find a good tenant to live in the house.

- You will NEVER have to deal with that tenant. In fact, you will NEVER have to deal with the property at all after you sell it to me. I will own the property just like you did and take care of everything. I am responsible for maintenance, upkeep, and repairs from damage that occurs, and any possible future damage. You get to go on with life and be rid of the stresses this property may have caused.

- After the date we agree I’ll take over payments, you will NEVER be required to make another payment. I will always make the full payments (principle, interest, taxes and insurance) on time and as you originally agreed with your lender. We prefer to do this directly online through your mortgage company website so you can log in and see the payment made each and every month. We can also do it by sending in a check, though most sellers prefer the instant online payment so they can receive the fast notification of the payment made.

- I make my money by managing the property, keeping it in good condition and being patient. I take full responsibility for the house.

This is a very simple process and takes about 15 days to close, depending on how backed up the title company is to close the transaction for us. In some instances we can expedite the closing to 10 days. As an added benefit, I’ll cover all the closing costs. (Note: If you need more time to move out, that is no problem, just let me know.)

Please be aware that the mortgage stays in your name. I’ll be making all the payments, but your name will still be on the mortgage. This was initially a concern for many of my past sellers, but when I showed them how it worked, they realized it was not as risky as it sounded.

Here are the criteria of the homes that I am seeking….

1. The value of the house should be between $50,000 and $300,000 (we sometimes buy lower or higher priced properties depending on situation)

2. The mortgage amount for all loans secured against the property must be AT or UNDER the real market value.

3. The mortgage rate must be below 8% and total payment PITI (Principal, Interest, Taxes & Insurance) must be below market rents. If the payment is above market rents, we would need to discuss if there are other options.

4. The house must be in “rentable” condition. If you aren’t sure on this, just let us know what the major defects are and we will tell you if they are a problem. We can likely handle light cleanup and touch-ups.

5. Payments should be current. If you are behind on payments, let us know. We may be able to catch up back payments to stop foreclosure proceedings.

That’s it. We are not terribly picky. We buy in “as is” condition as long as the condition is reasonable. You won’t have to pay for:

- Repairs

- Realtor costs

- Closing costs

- We won’t beat you up on the price.

You also won’t have to continue to pay the monthly mortgage payments after the date we agree I’ll take over payments… which you would have to do if you listed the property for sale on your own or with an agent.

If you would be interested in selling me your house, please go to this form and give us your information –> click here

Below are some common questions we get from sellers.

“I need my cash equity for a down payment to buy a new home.”

One option you have is to refinance the house and pull out your equity up to 95% of the value of the house. BUT… if you are using the money as a down payment on a new house, why not just get a loan on the new home that requires a smaller down payment. The money I pay you every month for the equity note will usually cover the higher payment on your new house.

“Can I still get a mortgage to buy another home, if this loan is still in my name?”

If you are looking to buy another home in the near future, please let us know this up front. The answer is “YES, in most instances you can.” Mortgage Lenders will see the loan for this house on your credit report, but will consider it a “sale” rather than a liability. As long as you maintain good credit, they will not count this loan against you as a debt and it will not affect the amount you can borrow for a new home. You can confirm this fact by calling up any mortgage lender and asking them.

“My mortgage has a “Due on Sale” clause. If I sign it over to you, won’t the mortgage company foreclose?”

99.9% of all mortgages in the nation have “Due on Sale” clauses built into them as standard language. It says that if you sell your house without paying off your mortgage, they have the right to foreclose. There are numerous homes sold “subject to” every day across the nation.

While the mortgage company has every right to call the loan due, it is rare to have a lender foreclose on a property for this reason: Lenders are in business to collect payments on loans. They are not in business to take over properties. Lenders have credit scores just like you and I. Their credit is damaged if they have a foreclosure on their books. If they get too many foreclosures, they will not be able to make loans. They usually do NOT want your house back… especially in these tough times for lenders. Though they can call the note due, we haven’t seen lenders looking for houses to foreclose on that are making their payments on time like clockwork.

Okay, I’d Like To Sell You My House

What Do I Do Next?

Just click on the link below and go to this website. It will ask you to give us the details of your house. If you still have questions, there is a place on that form for you to send them to us.

I look forward to working with you!

Best Wishes,

Jared Kluver